| Image | Title | Summary | Categories | Author | Date | Details | hf:categories |

|---|---|---|---|---|---|---|---|

| Annuity Buyers Beware, Part 1: S&P Monthly Point-to-Point Strategy, and Why It’s a Bad Bet | If you’ve discussed financial products with me at any length, you know I’m not a fan of annuities. They’re overly complicated and an opaque investment product that I don’t feel … | MI Perspective | Tom Moore | June 16, 2025 | View | moore-insights-perspective | |

| Market Update – May 2025 | Reflecting on the YTD Market Volatility & Recovery Monthly Market Summary The S&P 500 Index returned +6.3%, its strongest 1-month return since November 2023. Large Cap Growth stocks led the … | MI Market Updates | Moore Invested | June 4, 2025 | View | moore-insights-market-updates | |

| Boeing: The Grounding of an Iconic Aerospace Company | Boeing was once widely known for its engineering excellence and rose to prominence as a cornerstone of the global aerospace industry. But how the mighty have fallen. In recent years, … | MI Sheets | Tom Moore | May 28, 2025 | View | moore-insights-sheet | |

| MI Investments: JAZZ Pharmaceuticals | Since its inception in California in 2003, the company has evolved into a leading global biopharmaceutical manufacturer with an especially compelling presence in both oncology and neuroscience. A History of … | MI Sheets | Moore Invested | May 22, 2025 | View | moore-insights-sheet | |

| Market Update – April 2025 | The Rising Policy Uncertainty Leads to Increased Market Volatility Monthly Market Summary The S&P 500 Index returned -0.9%, outperforming the Russell 2000 Index’s -2.3% return. Technology was the top-performing S&P … | MI Market Updates | Moore Invested | May 2, 2025 | View | moore-insights-market-updates | |

| Sector Spotlight: Industrials | Although it may not be flashy, the industrials sector is one of the broadest and most influential parts of the economy. Investments in this sector can play a pivotal role … | MI Sheets | Moore Invested | May 1, 2025 | View | moore-insights-sheet | |

| Three Charts That Sum It All Up | What we have seen in the markets over the past week is historic. We will be talking about this for years to come. Trump’s tariff policy rollout will be discussed … | MI Perspective | Tom Moore | April 14, 2025 | View | moore-insights-perspective | |

| Market Update – Q1 2025 | Key Updates on the Economy & Markets Stocks fell in the first quarter after two consecutive years of gains exceeding +20%. The year started off strong, with the S&P 500 … | MI Market Updates | Moore Invested | April 1, 2025 | View | moore-insights-market-updates | |

| Tax Time: Marginal Income Tax Rates | The key to successful financial management lies in understanding the underlying factors involved. Income tax rates are one such element that has a significant impact on the amount of income … | Moore Insights 101 | Tom Moore | March 29, 2025 | View | moore-insights-101 | |

| How to begin Your Investment Journey | My sister-in-law recently celebrated her 50th birthday with a party in Florida, and it was such a blast! Around 100 people showed up, including her college friends, childhood buddies, and … | MI Perspective | Elizabeth Jackson | March 18, 2025 | View | moore-insights-perspective | |

| Market Update – February 2025 | The Market Navigates Economic and Policy Uncertainty in February Monthly Market Summary The S&P 500 Index returned -1.3%, outperforming the Russell 2000 Index’s -5.2% return. Six of the eleven S&P … | MI Market Updates | Moore Invested | March 4, 2025 | View | moore-insights-market-updates | |

| Industry Spotlight: Regional Banks | In the investment world, we’re constantly reminded that everything cycles. When the FDIC closed Silicon Valley Bank in March 2023, the regional banking industry was left for dead. It was … | MI Sheets | Moore Invested | February 28, 2025 | View | moore-insights-sheet | |

| Social Security Fairness Act | Teachers and other public servants have watched their Social Security benefits diminish due to complex provisions that few understood, but many felt deeply in their retirement years. That changed on … | Moore Insights 101 | Moore Invested | February 18, 2025 | View | moore-insights-101 | |

| Market Update – January 2025 | Stocks Rally as Market Leadership Shifts in Early 2025 Monthly Market Summary The S&P 500 Index returned +2.7%, marginally outperforming the Russell 2000 Index’s +2.5% return. Seven of the eleven … | MI Market Updates | Moore Invested | February 3, 2025 | View | moore-insights-market-updates | |

| 2025 Market Themes | 2025 Themes – 2024 marks second banner year in a row. Stock market is high, but economy shows little signs of weakness. Enthusiasm over new administration. Rolling back regulation and extending tax cuts should benefit both Wall Street and Main Street. | MI Perspective | Moore Invested | January 23, 2025 | View | moore-insights-perspective | |

| 2025 Interest Rates | 2025: Let’s Talk Interest Rates Interest rates continue to be a major investment theme leading into 2025. We are several months into a Federal Reserve easing cycle which began in … | MI Perspective | Tom Moore | January 8, 2025 | View | moore-insights-perspective | |

| 1031 Exchanges | The 1031; Tried and True and Maybe For You Preservation of capital, income, and wealth creation – these are common interests on the minds of investors. Another critical topic people … | Moore Insights 101 | Tim Partridge | January 8, 2025 | View | moore-insights-101 | |

| Market Update – Q4 2024 | Key Updates on the Economy & Markets There was no shortage of market-moving events in Q4. The stock market opened the quarter with a slow start in October, but the … | MI Market Updates | Moore Invested | January 7, 2025 | View | moore-insights-market-updates | |

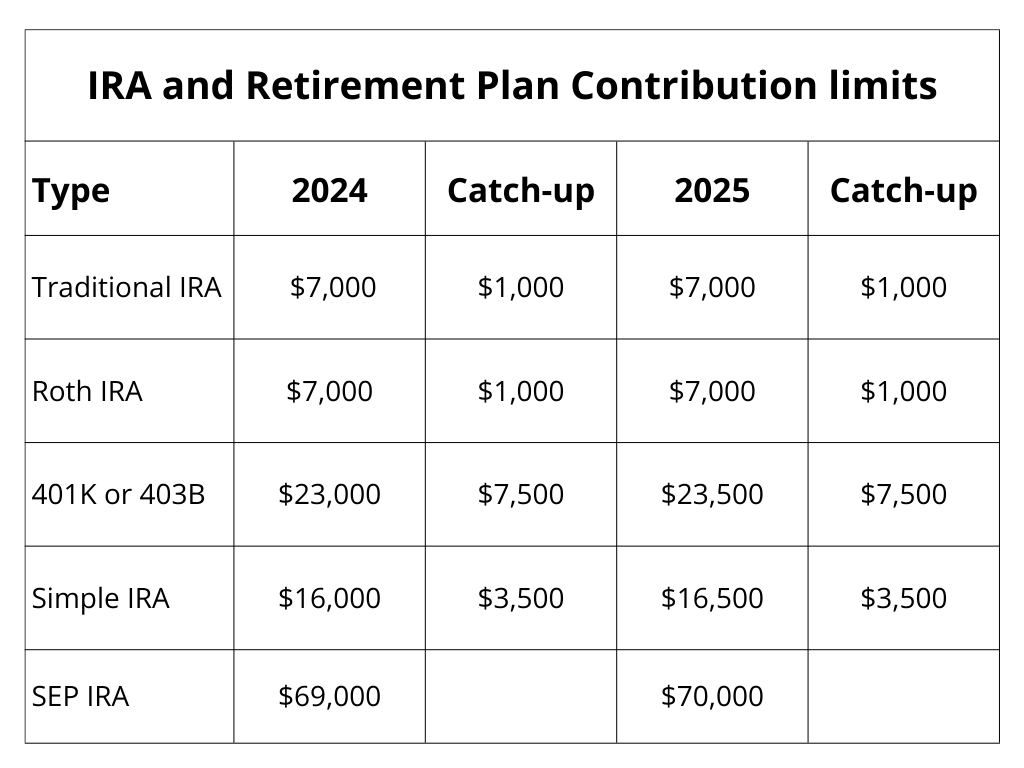

| 401(k) and IRA Contribution Limits for 2025 | Early planning is crucial for increasing the funds you’ll have in retirement. Depending on your financial and employment situation, several retirement plans can help you get the most out of … | Moore Insights 101 | Kellie Carter | December 13, 2024 | View | moore-insights-101 | |

| Data Center Mania: Investing in Data Centers | Digital transformation continues at an unprecedented pace, this time driven by huge strides in artificial intelligence. Data centers are an often overlooked yet critical part of this transformation, which comes … | MI Perspective | Tom Moore | December 3, 2024 | View | moore-insights-perspective | |

| MI Investments: Brookfield Renewable Partners, LP | Company History Brookfield Renewable Partners, LP (NYSE: BEP, BEPC) operates one of the largest publicly traded renewable power platforms in the world. Investing in Brookfield gives you a substantial portfolio … | MI Sheets | Moore Invested | November 18, 2024 | View | moore-insights-sheet | |

| Measures of Power | If you’re thinking about investing in utilities and renewable energy projects through companies like Brookfield Renewable Partners (see Brookfield article), Southern Company, or Duke Energy, you must understand units of … | Moore Insights 101 | Moore Invested | November 18, 2024 | View | moore-insights-101 | |

| 4 Reasons We Like Gold | Usually, when someone starts beating on gold’s drum, it’s to talk about how gold is a safe-haven asset that could protect your assets even in the event of societal collapse. … | MI Perspective | Tom Moore | October 24, 2024 | View | moore-insights-perspective | |

| Moore Insights 101: Understanding Your Fixed Income Allocation | Moore Insights 101: Understanding Your Fixed Income Allocation Should bonds and other fixed income assets be included in your portfolio? The answer to that will vary from person to person … | Moore Insights 101 | Tom Moore | October 18, 2024 | View | moore-insights-101 | |

| Market Update – Q3 2024 | The major development in 3Q24 was the Federal Reserve’s decision to cut interest rates by -0.50%, the first rate cut of this cycle. It came as the Fed shifted its focus, with unemployment rising to a 33-month high and inflation moving back to target. | MI Market Updates | Moore Invested | October 8, 2024 | View | moore-insights-market-updates | |

| Moore Insights 101: Understanding Your Equity Allocation | Does your investment statement look like a jumbled mess of financial lingo? Are terms like asset allocation, fixed income, and equity confusing? If you feel this way you are certainly … | Moore Insights 101 | Tom Moore | October 2, 2024 | View | moore-insights-101 | |

| MI Featured Stock: PayPal | As preference for online shopping continues to grow, transactions between businesses and consumers have seen a radical shift. PayPal has been at the forefront of this innovation since the very … | MI Sheets | Moore Invested | September 25, 2024 | View | moore-insights-sheet | |

| Market Update – August 2024 | Federal Reserve Set to Begin Cutting Interest Rates in September. The S&P 500 Index returned +2.3% in August, outperforming the Russell 2000 Index’s -1.7% return. Nine of the eleven S&P 500 sectors traded higher, led by Consumer Staples, Real Estate, Health Care, and Utilities. | MI Market Updates | Moore Invested | September 3, 2024 | View | moore-insights-market-updates | |

| Old School Thinking Post Convention | Diminishing Relevance Traditionally, the end of the second convention marked the start of the presidential election season. Candidates did not campaign full stop, and therefore the public did not pay … | MI Macro | Ned Davis Research | August 22, 2024 | View | moore-insights-macro | |

| Market Update – July 2024 | The Stock Market Experienced a Big Rotation in July Monthly Market Summary The S&P 500 Index returned +1.2% in July, underperforming the Russell 2000 Index’s +10.3% return. Ten of the … | MI Market Updates | Moore Invested | August 8, 2024 | View | moore-insights-market-updates | |

| August Market Volatility | Is This A Correction Or Recession? In the last three trading days, we have experienced significant volatility. This has, rightfully so, gotten investors very nervous about the future of the … | MI Perspective | Tom Moore | August 5, 2024 | View | moore-insights-perspective | |

| Market Update – Q2 2024 | Key Updates on the Economy & Markets The topic of interest rate cuts continues to dominate the financial markets. Investors are focused on when the Federal Reserve will lower rates, … | MI Market Updates | Moore Invested | July 8, 2024 | View | moore-insights-market-updates | |

| Market Update – May 2024 | Global Markets Trade Higher After April Sell-Off Monthly Market Summary The S&P 500 Index gained +5.1%, slightly outperforming the Russell 2000 Index’s +5.0% return. Ten of the eleven S&P 500 … | MI Market Updates | Moore Invested | June 6, 2024 | View | moore-insights-market-updates | |

| Why Stocks Have Rallied Despite Higher Rates | Not the Only Game in Town One of NDR’s themes over the past two years has been that higher interest rates make stocks less attractive versus bonds. To paraphrase quotes … | MI Macro | Ned Davis Research | May 29, 2024 | View | moore-insights-macro | |

| Seven Reasons Why No Recession | When the Fed started QT and raised rates sharply leading to an inverted yield curve starting in early 2022, Chairman Powell warned of pain to come, which nearly all economists believed would lead to recession. We did get a slowdown for a while, but no recession, and today I would like to offer… | MI Macro | Ned Davis Research | May 7, 2024 | View | moore-insights-macro | |

| Why Do Investors Expect Fewer Interest Rate Cuts This Year? | One reason is that inflation progress is slowing. Another reason is that the U.S. economy remains resilient despite higher rates. Figure 4 graphs three data points that underscore this resilience. … | MI Macro | Moore Invested | April 23, 2024 | View | moore-insights-macro | |

| Market Update – Q1 2024 | Key Q1 2024 Updates on the Economy Stocks continued their upward trajectory in early 2024. The S&P 500 returned more than 10% for a second consecutive quarter, setting multiple new … | MI Market Updates | Moore Invested | April 17, 2023 | View | moore-insights-market-updates |