Is This A Correction Or Recession?

In the last three trading days, we have experienced significant volatility. This has, rightfully so, gotten investors very nervous about the future of the US economy. Investors are asking, “Is this a correction or recession”.

Well, at the moment, it looks like this is simply a pullback/correction in the bull market we have enjoyed for the last year. Our US Recession Watch models are indicating one recessionary reading out of ten. This comes from the contracting ISM reading from last week. Not to say that the probability of recession is zero. There is always a possibility…however, this looks more like a correction led by overheated technology stocks that were at record levels and needed to take a breather.

Could this volatility have a silver lining? We believe that the Federal Reserve needs to lower interest rates. Our consensus view was that rates would be lowered in December. This could indeed bring us a rate decrease sooner. Some of the Federal Reserve talking heads are already floating the idea of an emergency rate cut. This sounds a bit extreme, but regardless, moving the conversation from higher rates to lower rates sooner is a big swing in the right direction.

________________________________________

Positive Catalyst Going Forward

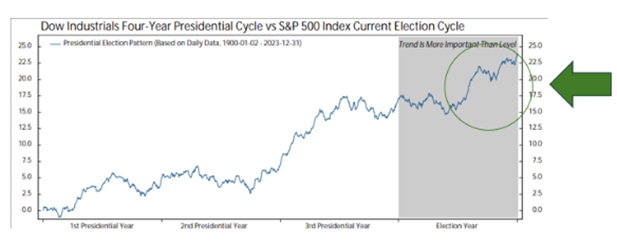

People (including me) find it hard to believe that politics are a positive catalyst for our market. Very soon, we will be even further inundated by the election and unending media attention on our two candidates. The period leading up to the election is a time of uncertainty and as we get to the final day that uncertainty starts to dissipate. I know it is hard to believe but the chart below shows the seasonality of elections and how the certainty of knowing the next president tends to be a positive for the stock market.

The Artificial Intelligence (AI) buildout will continue.

Many do not realize the magnitude of the AI buildout that is just beginning. Data centers (the backbone of AI) are expected to grow at 10%through 2030. AI software, processors, storage, data centers, servers, etc. are all items that will fuel our economy in the years to come. Expectations are that this infrastructure buildout will be similar to the telecom and internet buildouts in the 1990s and more recently the cloud computing boom. The eventual uses of AI are yet to be determined but regardless the buildout is a significant economic event that will drive our economy for the next few years.

________________________________________

Our mailing address is:

2827 Peachtree Rd NE, Suite #510

Atlanta, GA 30305

(404) 905-2290