Early planning is crucial for increasing the funds you’ll have in retirement. Depending on your financial and employment situation, several retirement plans can help you get the most out of your investments. The Internal Revenue Service (IRS) limits the annual amount you can contribute to a retirement plan based on your age and the type of account. Understanding your options and maximizing your contributions is essential for planning a comfortable retirement.

What Is an IRA?

An individual retirement account (IRA) is a tax-advantaged account that helps you save for retirement. It comes in two main forms. A traditional IRA allows you to invest and grow pre-tax funds until your retirement, and you’ll pay taxes on your withdrawals. A Roth IRA allows you to contribute funds that have already been taxed. Your funds can grow tax-free, and you don’t pay taxes when you take out withdrawals in retirement. Anyone with an earned income can contribute to an IRA.

2025 IRA Contribution Limits

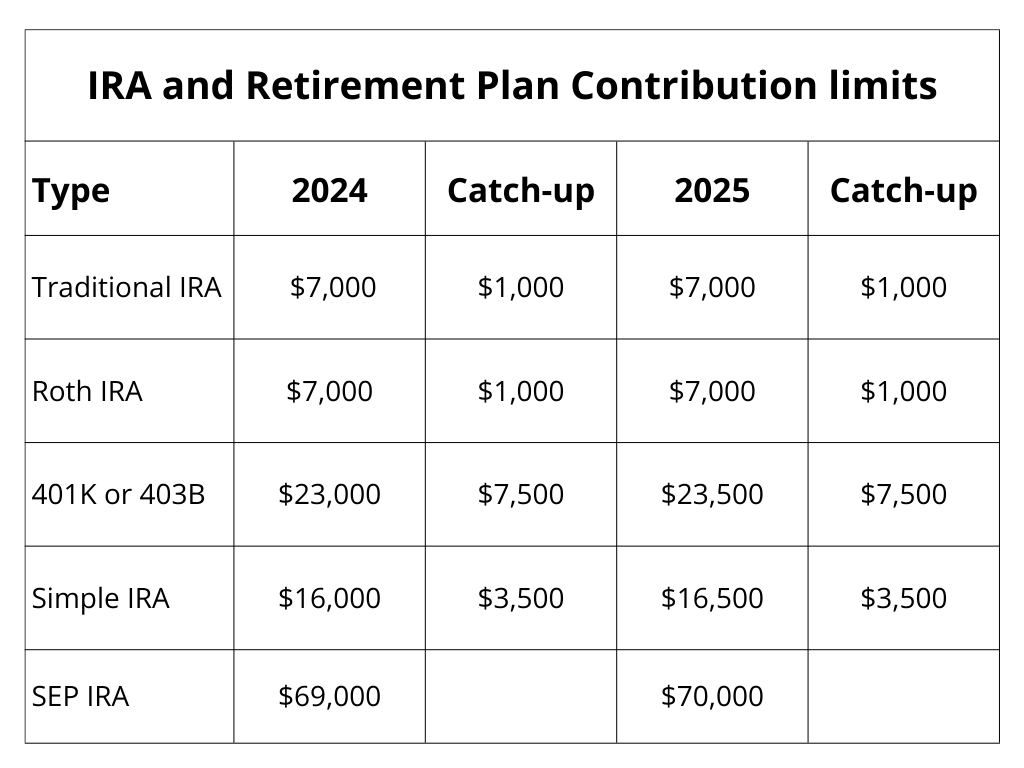

Traditional and Roth IRA contribution limits in 2025 will remain the same as in 2024, maxing out at $7,000 per year for individuals under 50. Those 50 or older can invest an additional $1,000 in catch-up contributions, upping the limit to $8,000 annually.

What Are 401(k) and 403(b) Plans?

401(k) and 403(b) plans are employer-sponsored retirement savings plans for employees. These plans differ depending on the type of organization that sponsors them. Any corporation or business can offer their employees 401(k) plans. However, only nonprofit organizations, public schools, and certain religious organizations can offer 403(b) plans.

For these retirement plans, employees can choose to contribute a portion of their pre-tax salary. In some cases, employers will match employee contributions up to a certain percentage. These contributions can then grow untaxed until retirement. The account holder pays taxes on the funds they withdraw in retirement.

2025 401(k) and 403(b) Contribution Limits

Employees under 50 years old can contribute $23,500 to their 401(k) and 403(b) plans in 2025. This new contribution limit is up from $23,000 in 2024. The IRS allows a catch-up contribution limit of $7,500 for employees over 50, which remains the same as in 2024.

What Are SIMPLE and SEP IRAs?

Two additional retirement savings plan options are Simplified Employee Pension (SEP) IRAs and Savings Incentive Match Plan for Employees (SIMPLE) IRAs. SIMPLE and SEP IRAs are employer-sponsored plans for small businesses where the money you or your employer contributes grows tax-free until you withdraw it in retirement. Businesses with 100 employees or fewer can offer SIMPLE IRAs for employees.

SIMPLE IRAs require employers to match employee contributions up to 3% of their compensation or provide a non-elective 2% contribution of the employee’s salary without any employee contributions. SEP IRAs, meanwhile, are for self-employed individuals and small-business owners. Unlike with SIMPLE IRAs, only employers can fund SEP IRAs.

2025 SIMPLE and SEP IRA Contribution Limits

SIMPLE and SEP IRA contribution limits are higher than in 2024. In 2025, SIMPLE IRAs allow for $16,500 in annual contributions, which is up $500 from 2024. SEP IRAs have increased by $1,000 to $70,000 annually. SIMPLE IRAs allow an additional catch-up contribution of $3,500 for individuals over 50 years old. Because SEP IRAs are employer-funded, they do not offer a catch-up contribution.

Why You Should Maximize Your Contributions

Regardless of the retirement plan you choose, it’s crucial to maximize your contributions to receive tax benefits. Contributing to tax-deferred accounts, such as a 401(k), will allow you to pay less taxes today and instead pay taxes upon withdrawal in retirement. Making contributions to a tax-free account, such as a Roth IRA, requires you to use after-tax funds, but this means you won’t pay any taxes upon withdrawing your funds in retirement.

Both tax-deferred and tax-free accounts allow you to grow your investments over time without paying capital gains taxes. The more you contribute, the more compound growth will occur over time, and your retirement fund will be larger.

Contribution to retirement plans with employer matches, such as a 401(k), is especially important. The employer match is free money that will compound and grow your retirement savings over time. Maximizing your contributions to your retirement accounts will reduce stress and give you peace of mind as you near retirement age.

________________________________________

Our mailing address is:

2827 Peachtree Rd NE, Suite #510

Atlanta, GA 30305

(404) 905-2290