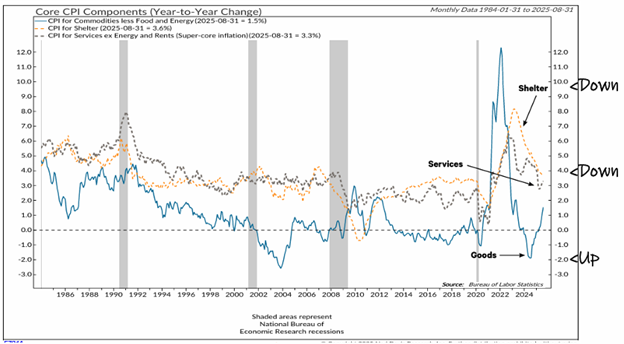

“Inflation” is a vague economic term, yet it’s one of the most important ways to tell how the economy is doing. Many news outlets report on the Consumer Price Index (CPI), which contains a lot of pricing information. Economists, on the other hand, use the related Core CPI, which only looks at three main things: shelter, services, and products. It leaves out food and energy prices, which can vary a lot from month to month.

The components of the Core CPI better show how pricing pressures are affecting individuals and the economy as a whole.

Shelter

Housing costs rose by almost 8% in 2023, the highest rate since the 1980s. Housing is the biggest expense for most people.

By August 2025, the growth rate of shelter costs had dropped back to 3.6%. Rent prices rose very slowly over those two years, and the booming housing market froze over, easing pricing pressure in housing markets nationwide.

However, for families renewing their lease or hunting for a new house, the rate doesn’t bring much relief. Costs are still rising, just more slowly.

Services

“Super-core” inflation, which doesn’t include energy or rent, tells a similar story.

Services inflation, covering the costs of anything from going to the doctor to getting a haircut to fixing your car, was over 6% in 2022–2023. But by August 2025, it had dropped to 3.3%. The lower trend is good news, but it’s still persistently over the Fed’s 2% inflation target.

Because service prices are mostly based on salaries, the steady drop shows that the tight job market’s upward pressure on wages is starting to ease.

Goods

The pricing of goods tells the most complicated story. Goods prices stayed range-bound throughout the 2010s. During the pandemic, prices shot up, but then dropped significantly between 2022 and 2024. This falling trend, however, came to an end by August 2025 as goods inflation rose 1.5% year-over-year.

That may not seem like much compared to housing or services, but it’s a big difference from the deflationary conditions of 2023. Trade policies and tariffs are the obvious culprits driving this, as companies raise the prices of imported electronics, clothes, and other goods to cover their increased costs.

Why It Still Feels Like a Lot

Two of the three main components of inflation are falling, but the average household still pays more than the historical norm for basic goods and services. This makes it hard to connect the dots between improving headline data and daily life.

For many households, Core CPI increases translate into continued financial pressure — less acute than two years ago, but far from the price stability of the previous decade.

________________________________________

Our mailing address is:

2 Ravinia Drive NE, Suite 1705

Atlanta, GA 30346

(404) 905-2290