Data centers and semiconductors are market-driving narratives right now because they are the backbone of AI computing. Marvell Technology is a “picks and shovels” play, meaning it provides the tools that support AI development. And though the AI boom may be recent, Marvell Technology has been in the game for over 30 years. It has more than 7,000 employees with headquarters around the world and holds more than 10,000 patents.

Marvell Technology at a Glance

The value Marvell Technology offers investors lies in how integral its products are for AI and 5G services. Marvell Technology is a fabless semiconductor company. In other words, it’s primarily a research and development company that outsources chip production. Because of that division of service, Marvell doesn’t have to concern itself with running factories directly. That business structure allows Marvell Technology to fulfill its mission to move, store, process, and secure the world’s data faster and more reliably than anyone else.

Its products are used primarily in three markets: data centers, enterprise networking, and carrier infrastructure. Of those, data centers have become the most important growth driver. That’s because data centers are being redesigned to handle not just more computing, but far more data movement between systems.

Marvell addresses this through a broad portfolio that includes custom compute chips, high-speed networking switches, and interconnect products. ‘Custom compute’ refers to chips that are designed for specific customers or workloads, rather than general-purpose processors. These designs are typically used by large cloud providers that want hardware optimized for their own AI and data processing needs.

Another core area is interconnect. This includes components that help data travel cleanly and efficiently across servers and racks inside a data center. As speeds increase, signals degrade more quickly over distance. Marvell’s interconnect products help maintain signal integrity so data can move reliably at extremely high speeds.

Acquisitions Fuel Growth

Marvell has been selective with acquisitions, using them to strengthen specific parts of its infrastructure portfolio rather than to expand into unrelated areas. A recent example is its acquisition of Celestial AI, which focuses on optical connectivity inside data centers. Optical technology uses light instead of electrical signals to move data, allowing for higher speeds and lower power use as systems scale. This aspect matters as AI workloads grow larger and more distributed across multiple processors. The acquisition fits Marvell’s broader strategy of addressing data movement bottlenecks, reinforcing its role as an infrastructure provider.

The Bottom Line

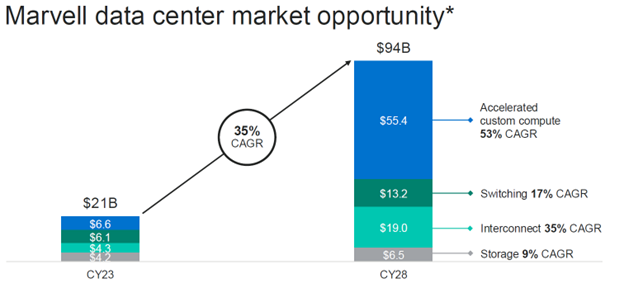

Marvell Technology projects that its data center market reach could grow from about $21 billion in 2023 to about $94 billion by 2028. That means a compound annual growth rate (CAGR) of about 35%, which is very high for a company of Marvell’s size. Accelerated custom compute is the part of the opportunity that is growing the fastest. Marvell expects it to grow by more than 50% every year.

As cloud providers make systems that are specifically designed for AI workloads, the need for custom chips and tightly integrated infrastructure grows. Interconnect hardware is next in line, as data centers need faster and more reliable ways to move data between systems. Switching and storage grow more steadily, but they are still important parts of the overall architecture. ValueLine expects that revenue will grow by about 16% per year and earnings will grow by about 18.5% per year. The stock doesn’t seem cheap at first glance because it costs about 28 times what it earns (PE). But when you look at the growth rates, paying that valuation starts to look reasonable.

________________________________________

Our mailing address is:

2 Ravinia Drive, NE Suite 1705

Atlanta, GA 30319

(404) 905-2290