Key Updates on the Economy & Markets

After a volatile start to the year, the stock market staged a strong rebound over the last three months. In Q1, market sentiment was cautious due to rising policy uncertainty, concerns about slower economic growth, and questions about the longer-term outlook in the artificial intelligence industry. In Q2, caution gave way to renewed optimism as tensions eased, tariffs had a limited economic impact, and companies posted stronger than expected Q1 earnings. The dramatic shift in sentiment across the quarters created two distinctly different market environments.

The first half of 2025 was busy and eventful, but for all that happened, markets ended the first half not far from where they started the year. The S&P 500 returned +6.1% through the end of June after being down over -15% at one point, and it trades at a similar valuation to the start of the year. Long-term interest rates, as measured by the 30-year U.S. Treasury bond yield, ranged from 4.40% to 5.10% but ended the first half of the year near 4.80%, where it started. For those not following markets closely, it might seem as though little has changed. In this letter, we recap the second quarter, discuss how market conditions changed from Q1 to Q2, and look ahead to the second half of 2025.

Markets Ride a Wave of Policy Uncertainty

This year has been defined by large, frequent shifts in U.S. trade policy. There were periods of increasing tariffs and targeted actions against trading partners followed by exemptions and temporary agreements. While the first quarter was marked by trade escalation, the second quarter saw a significant shift toward de-escalation.

The escalation started in February and March with targeted tariffs on imports from China, Canada, and Mexico, along with broader duties on global steel, aluminum, and auto imports. Tensions peaked in early April with the announcement of sweeping tariffs on most imports. However, the tone quickly shifted a week later toward de-escalation, when the administration paused reciprocal tariffs for all trading partners except China. By early May, the White House announced a trade agreement with China, signaling a further move toward easing tensions.

While Q2’s de-escalation efforts lowered tariffs from the initial extreme levels, uncertainty remains. In late-May, a U.S. trade court ruled the tariffs unconstitutional, and by early June, the administration was weighing new tariff actions. As July and August deadlines on tariff exemptions approach, the policy environment remains fluid, with several key details still unresolved.

Monitoring Tariffs’ Early Economic Impacts

Trade policy uncertainty impacted economic data and temporarily boosted activity early this year, as businesses and consumers rushed to buy goods ahead of anticipated tariffs. The front-running behavior was evident in Q1, with monthly imports of consumer goods and industrial supplies rising. Separately, auto-related tariffs led to a surge in vehicle sales in March and April. The spikes don’t appear to be seasonal but rather a response to anticipated tariff changes, suggesting businesses and consumers pulled forward purchases to avoid potential cost increases.

Early inflation readings have been encouraging, but concerns remain about the potential inflationary impact of tariffs. Economists caution May’s inflation report may not fully capture the tariffs’ impact, as it takes time for supply chains to adjust. This has sparked a debate about the path forward: one group believes companies will raise prices and pass through tariffs, while the other thinks firms will absorb the higher costs to remain competitive. The upcoming corporate earnings season will provide an early look at how companies are navigating tariffs and policy uncertainty, including updates to their pricing strategy and earnings guidance for coming quarters.

Federal Reserve Urges Patience Due to Uncertainty

Tariffs and trade policy uncertainty have also influenced Fed policy. The central bank faces a difficult policy tradeoff: tariffs could lead to higher inflation, but they could also slow economic growth if higher prices reduce demand for goods and services. Given the uncertainty, the Fed held interest steady at its May and June meetings, reiterating that it wants more data before deciding on interest rate cuts.

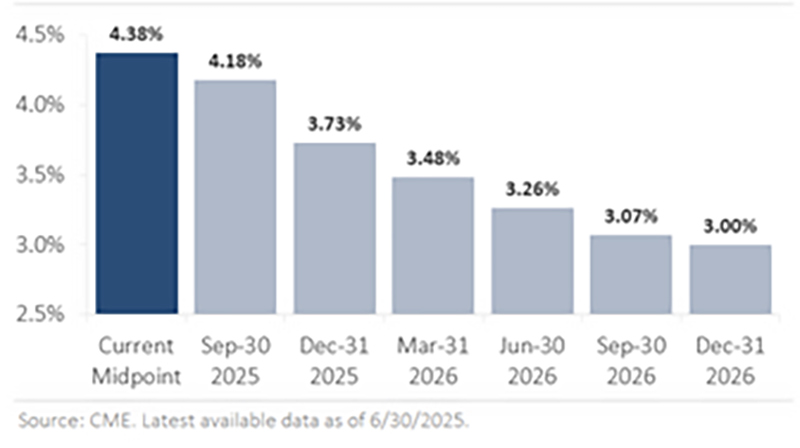

The market has adopted the Fed’s wait-and-see approach. The chart below graphs the market’s rate cut forecast through the end of 2026, based on current fed funds futures pricing. The Fed’s current target range is 4.25%–4.50%. The chart shows the market expects a gradual near-term decline in rates, with the first anticipated cut occurring in September. The pace of rate cuts is then forecast to increase in Q4 and continue throughout 2026. Looking ahead to December 2026, the market expects the Fed to lower interest rates by approximately -1.25% over the next 18 months.

Market Interest Rate Cut Forecast through 2026

Based on this current market pricing, investors expect the Fed to lower interest rates at a modest pace. This likely reflects the inflationary risk from tariffs but also their limited economic impact thus far. It’s important to emphasize that the market’s forecast will likely change as more data becomes available, with the timing and size of rate cuts depending on inflation, trade policy developments, and the economy’s trajectory over the next several quarters.

Equity Market Recap – S&P 500 Ends Q2 at Record High as Stocks Rebound from April Lows

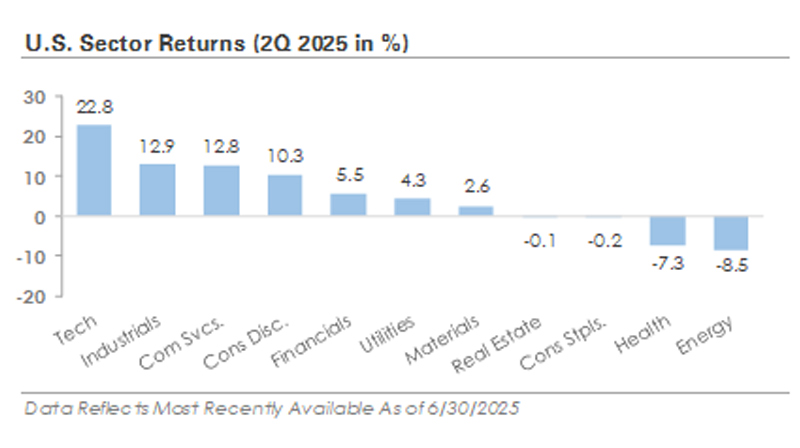

Stock market returns reveal a dramatic change in market leadership. Here’s a comparison of Q2 and Q1 returns. The S&P 500 rose +10.8% in Q2 after falling -4.3% in Q1, while small caps (Russell 2000) gained +8.5% after a -9.5% drop. Growth and tech stocks led the market reversal in Q2. The Russell 1000 Growth Index jumped +17.7% after a -10% Q1 decline, and the Nasdaq 100 gained +17.8% after an -8.1% loss. The “Magnificent 7,” a group of large-cap technology stocks, returned +21.0% after falling -15.7% in Q1. In contrast, the Russell 1000 Value Index posted muted gains, +3.7% in Q2 compared to Q1’s +2.1%. Defensive sectors that outperformed early in the year lagged as investors rotated toward riskier areas.

Despite the reversal from Q1 to Q2, one trend remained intact. International stocks outperformed U.S. stocks for a second straight quarter, with developed and emerging market stock indices both returning more than +11% in Q2. Year-to-date, developed and emerging market stocks have returned +20.2% and +16.4%, respectively, outperforming the S&P 500 by over +10%. Most of the outperformance can be attributed to a weaker U.S. dollar, which is being impacted by tariffs, policy uncertainty, and a rotation out of U.S. stocks into international stocks.

Credit Market Recap – Bonds Search for Direction

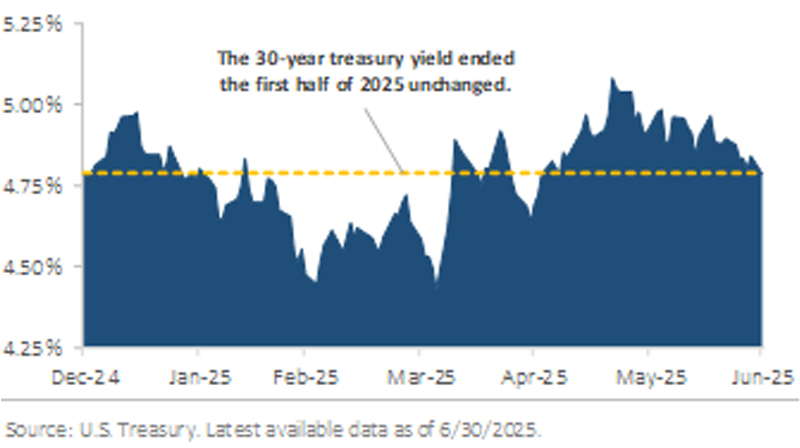

Like the stock market, the bond market experienced a significant shift in sentiment from Q1 to Q2. The chart below graphs the 30-year U.S. Treasury yield since the start of the year. The 30-year yield was selected for its sensitivity to investor sentiment and economic forecasts. While Fed policy heavily impacts shorter-maturity Treasury yields, longer-maturity yields, such as the 30-year, are influenced by expectations for economic growth and inflation.

This chart shows the 30-year yield declined in Q1 amid rising policy uncertainty and concerns about slower economic growth. The combination prompted investors to move into longer-maturity Treasury bonds, driving the 30-year yield down from 4.80% at the end of 2024 to 4.40% in early April. However, the trend reversed in Q2, as market attention shifted from slower growth and policy uncertainty to worries about higher inflation and widening fiscal deficits. The 30-year yield peaked around 5.10% in late May before falling back to 4.79% by the end of June. Despite the volatility and changing narratives, the 30-year yield is mostly unchanged year-to-date.

Corporate bonds outperformed Treasury bonds in Q2, with lower quality corporate bonds outperforming. Corporate bonds, particularly high yield, benefited as tensions eased and investor sentiment improved, which caused corporate credit spreads to tighten after they widened in Q1. High yield produced a total return of +3.7%, outperforming investment grade’s +2% return after underperforming in Q1.

2025 Mid Year Outlook – Staying Disciplined and Focusing on What You Can Control

At the start of the year, few could have anticipated the events and market volatility that would unfold over the first six months. The market’s early-year optimism was disrupted by policy-driven volatility, a dynamic that could persist in the second half of the year. However, despite the policy uncertainty and market volatility, financial markets have proven resilient. In Q2, the S&P 500 posted its strongest quarterly return since Q4 2023, fully reversing the Q1 selloff.

The rebound suggests the market believes the economic impact of tariffs will be modest and temporary. However, the economy is highly complex, and introducing trade policy volatility could have a range of impacts. Tariffs could be short-lived, causing only minor disruptions as businesses and consumers adjust. In contrast, the cumulative effects of trade policy uncertainty could start to weigh on the broader economy in the second half of the year, leading to slower economic growth, weaker labor demand, and higher inflation. For now, markets seem to be pricing in a blend of the two scenarios: expecting growth to moderate later this year while remaining cautiously optimistic that the long-term effects will be limited.

The coming months will provide important context, with economic data and earnings reports capturing a period marked by both trade escalation and de-escalation. Corporate earnings commentary will shed light on how trade developments have affected business conditions, and companies will provide earnings guidance for the coming quarters. Second-quarter GDP growth will be released in late July, offering insight into how shifting trade policy and tariffs have impacted the U.S. economy. Along the way, there will be more trade policy developments, along with monthly economic data releases to track tariffs’ impact on consumer spending, manufacturing activity, and the labor market.

Market volatility can be unsettling, but it’s a normal part of investing. Periods of enthusiasm often lead to recalibration. It’s natural to feel uncertain, but history shows that staying invested through volatility and maintaining a longer-term view is a prudent approach. By maintaining a diversified portfolio aligned with your long-term goals, we are positioned to weather the market’s swings.

With uncertainty on the horizon, the theme for the second half of 2025 is simple: focus on what you can control. It’s impossible to know what impact the tariffs will have on the global economy or whether the administration will change its mind on tariffs again. However, history shows the economy and market usually adapt to changing environments. Rather than reacting to headlines and market volatility, the best course of action is to stay focused on your financial plan, maintain a diversified portfolio, and make decisions in line with your long-term goals.

________________________________________

Our mailing address is:

2827 Peachtree Rd NE, Suite #510

Atlanta, GA 30305

(404) 905-2290