If you read Part 1: Monthly Pt to Pt and Part 2: S&P 500 Capped Strategy of my series, then you now know annuity returns are pretty terrible. Advertised as a way to protect your investment from market downturns, the reality is that you’ll be stuck with an underperforming investment. Thanks to gain caps (some monthly, some annually), annuities are often outperformed by other low-risk options like treasury bonds and CDs.

Even worse, once annuity holders commit, they are locked in. So even if you decide your money would be better invested elsewhere, you’ll have to pay a hefty surrender fee to escape the annuity.

Understanding Surrender Periods

When funding annuities, you agree to leave your money in the account for a fixed number of years – this is the surrender period. If you draw out money before this contract period is up, you’ll get hit with a surrender penalty.

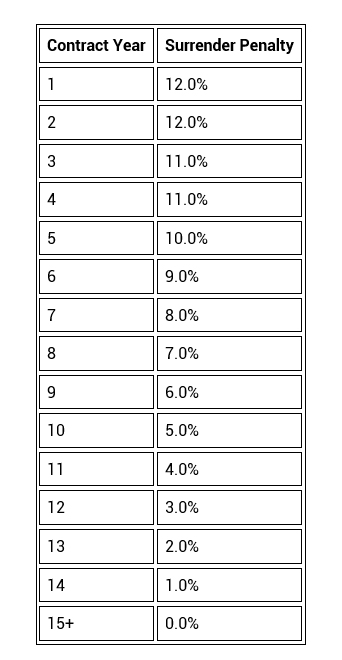

Surrender fees are charged as a percentage of your withdrawal. So, if you withdrew $10,000 with a 4% penalty, you’d be charged $400. Surrender periods and their associated fees vary from annuity to annuity. As an example, here is the surrender period breakdown for a Midland Life Annuity.

If you add to your annuity after initial funding, things can get really messy, leaving you with multiple surrender periods and fees attached to individual chunks of money.

Why Insurance Companies Penalize You for Early Withdrawals

Surrender penalties act as a deterrent, helping ensure you keep your money in the annuity as long as possible. The longer the money stays put, the more the insurance company makes off your investment.

The inverse is also true. By withdrawing early, you are costing the insurance company money. When you buy an annuity, the salesperson usually earns a commission. Their commission rate is often the same as your first year surrender fee, less 1%. So, with our Midland example above, the commission rate is likely 11%. If you invested $100,000 in this annuity, the salesperson would be paid out $11,000 upfront.

This is the main reason first year surrender fees are so high — the insurance company has to recoup the commission paid plus any other expenses associated with managing your account.

The Cost of Getting Out of Your Annuity

Considering the fee, is it even worth leaving your annuity early? Yes, especially if the market is doing well or you are close to the end of your surrender period. Let me show you what I mean.

Bob is an investor who removes $100,000 from his annuity and gets hit with a 5% surrender penalty. Bob then takes this $95,000 and places it in an investment account. If that account earns a 5% return, Bob makes back his $5,000 in just one year. If the account earns 8%, he’ll make back the money in eight months. And, if the return hits 12%, he’ll recoup the full $5,000 in just six months.

These returns aren’t just random numbers either – the S&P has delivered a 10% return on average since its inception in 1927.

If you’re only one to two years into your surrender period and there is a lengthy market downturn, you may need to be more strategic about when to exit your annuity.

Insurance vs. Investment

Fixed and Indexed annuities are not direct investments — they are insurance products. The “protection” they offer from market downturns comes at a significant cost. Not only is your potential growth restricted, but you are often locked in for 10+ years.

At Moore Invested, you won’t see this type of insurance product. In fact, you won’t see any investment product that charges a surrender fee. We take our job as a fiduciary seriously, and we only offer investments and advice that allow our clients the flexibility to change course if it is in their best interest.

________________________________________

Our mailing address is:

2827 Peachtree Rd NE, Suite #510

Atlanta, GA 30305

(404) 905-2290