My clients know I’m no fan of annuities. In our first article on the monthly point-to-point strategy Annuity Buyers Beware, Part 1, I showed how that strategy favors the house like a casino game. Let’s turn to the equally troubling S&P 500 Capped Strategy used in fixed indexed annuities (FIAs) and related index-linked approaches.

The Promise vs. Reality

This strategy is marketed as the perfect investment solution: “Get the upside of the market but no downside” sounds appealing. Investors envision modest caps — perhaps 12% returns when markets gain 20%.

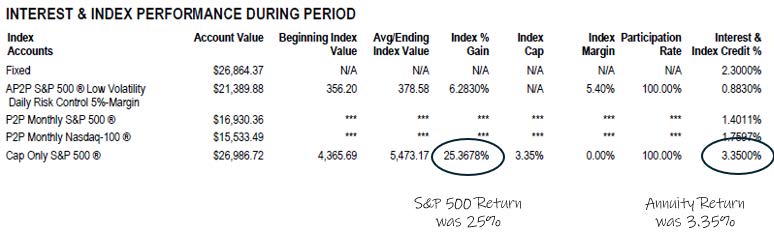

The harsh reality? When the S&P 500 soared 25.36%, the annuity delivered a paltry 3.35%.

Consider this real Midland National annuity statement from June 2023 to June 2024:

That’s not just disappointing — it’s staggering. Investors lost nearly 87% of potential gains. During a banner year for markets, annuity holders received table scraps.

Even more telling? On June 21, 2023, a plain 2-year Treasury bond yielded 4.72%. That’s right — a simple government bond would have beaten this “innovative” market-linked product during one of the strongest bull markets in recent years.

Why Performance Falls Short

The disconnect between expectation and reality is striking. Why such poor performance? Insurance companies limit your returns through three key mechanisms:

- They purchase S&P 500 options to create market exposure without downsiderisk. These options are expensive, directly reducing your potential cap.

- Interest rates heavily influence cap levels. Lower rates mean lower caps — thecompany has less yield to work with.

- Profit margins are built into every calculation. These products are designed to beprofitable for insurers first. The difference between what they earn and what theypay you becomes their profit.

What’s particularly misleading is how these caps can change over time. Many annuities start with more attractive cap rates to entice new customers, then gradually lower them once investors are locked in. A 5% initial cap might drop to 3% in later years, with little recourse for the contract holder.

The True Cost of Downside Protection

The “no downside risk” promise is seductive, especially as retirement approaches. But this protection comes at a steep price rarely highlighted in glossy brochures.

That 3.35% return costs investors:

- 22 percentage points of market growth

- 14 years of liquidity (due to surrender periods)

- Investment flexibility to adapt to changing conditions

- Tax advantages available through other vehicles

Even in modest market years, the gap persists. When the S&P 500 gains 8-12%, these annuities typically return just 3-5%.

The Long-Term Math

The long-term impact is mathematical certainty, not opinion. A $100,000 investment growing at 3.5% for 20 years becomes about $199,000. At 7%, it reaches nearly $387,000. At 10%, it grows to $673,000 — more than triple the annuity result.

Why do these products still sell? Fear is a powerful motivator. The sales pitch focuses on recent market drops while minimizing the opportunity cost during growth periods. I’ve reviewed countless marketing materials featuring complex charts highlighting downside protection during cherry-picked timeframes, while burying the catastrophic performance gap during bull markets.

The psychology is brilliant but problematic: emphasize the pain of market drops while obscuring decades of potential growth sacrificed for that protection.

What Investors Should Know

If you’re considering an annuity with a capped strategy, demand to see actual historical returns, not hypothetical illustrations. Ask for specific examples showing real client results versus the index during various market conditions. Sales brochures tell one story; performance statements tell the truth.

But what happens when investors face the harsh reality of 3.35% returns while the market soars 25%? Many rush for the exits — only to discover the final trap: surrender charges. Next up, I’ll expose how these punitive exit fees can lock you into years of mediocre performance. The pain of watching your neighbor’s simple index fund triple their returns is one thing; paying a 10% penalty to escape is another entirely.

________________________________________

Our mailing address is:

2827 Peachtree Rd NE, Suite #510

Atlanta, GA 30305

(404) 905-2290